By Mike Collopy, CFP®

Making gains on your investments is a positive sign that the markets are working in your favor. Unfortunately, cashing in on your appreciated assets means you will also have to pay some taxes on your gains. Taxes are not avoidable, but understanding how capital gains taxes work will help you keep more of what you earned. Here are 4 tips to minimize your tax liability.

1. Wait a Little Longer to Sell

Timing the sale of your investments is critical to lowering your capital gains taxes. Selling your shares after holding for less than a year will result in a short-term capital gains tax. This means that all the gains you made from the sale of the stock will be taxed at your ordinary income rate, which can be 32%-37% for high-earners. (1) Holding on to an asset for more than one year will be taxed at the long-term capital gains tax rate, which can be 0%, 15%, or 20%. (2)

Holding periods are also critical when it comes to the sale of real estate. If you sell your primary home and you lived in the home for at least two years of the five-year period before the sale, the IRS allows you to exclude the first $250,000 of capital gains (or $500,000 for a married couple filing jointly). (3) While the capital gains exclusions do not apply to investment properties, you may be able to utilize like-kind exchanges to defer capital gains tax by reinvesting in other real estate.

2. Utilize Tax-Loss Harvesting (TLH)

Losing money on your investments is usually a bad thing, but utilizing a tax-loss harvesting strategy means you can claim capital losses to offset your capital gains. If you show a net capital loss, you can use the loss to reduce your ordinary income by up to $3,000 (or $1,500 if you are married and filing separately). Losses above the IRS limit can be carried over to future years. (4) Sometimes it is advantageous to sell depreciated assets for this reason. A tax-loss harvesting strategy can help minimize your tax liability and keep more money in your pocket. However, trying to reduce taxes shouldn’t come at the expense of maintaining a thoughtful asset allocation in your portfolio.

3. Asset Location

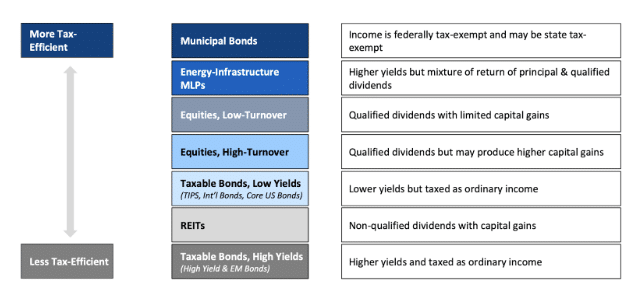

Some investments will be more tax-efficient than others. For example, a municipal bond is considered the most tax-efficient security because income from municipal bonds are federally tax-exempt and may be state tax-exempt. Investments like REITs (Real Estate Investment Trusts) are considered less tax-efficient because dividends are non-qualified, meaning they are taxed as ordinary income as opposed to a special lower rate.

Like assets, there are investment accounts that are more tax-friendly. Tax-advantaged accounts allow you to defer paying taxes on the gains or earnings to a later date. For example, a traditional IRA or a 401(k) will allow you to contribute using pre-tax income and withdrawals are taxed when you retire, when your income is typically lower.

Pairing tax-advantaged accounts like a 401(k) with tax-inefficient assets like a high-yield bond and pairing taxable accounts (individual, joint, trust, etc.) with more tax-efficient assets will create a more optimal mix to minimize tax liability. Placing investments that have higher tax rates with accounts that delay taxes will help reduce the amount you owe. Since you are not expected to pay federal taxes on something like income from a municipal bond, there is no use placing it in a tax-advantaged account because there are no taxes to delay.

4. Understand Cost Basis & Share Lots

When you buy any amount of stock, the stock is assigned a lot number regardless of the number of shares. If you have made multiple purchases of the same stock, each purchase is assigned to a different lot number with a different cost basis (determined by the price at the time of each purchase). Consequently, each lot will have appreciated or depreciated in different amounts. Some brokerage accounts use first in, first out (FIFO) by default. If you utilize FIFO, your oldest lots will be sold first. Sometimes FIFO makes sense, but not always. Sometimes it is ideal to sell lots with the highest cost basis, which is commonly done as part of a tax-loss harvesting strategy.

Passing on assets as an inheritance can also increase your cost basis. Assets passed on to the next generation at the time of death allow your heirs to pay tax only on capital gains that occur after they inherit your property, through a one-time “step up in basis.” (5) For example, when one spouse dies, assets passed on to the surviving spouse will have a cost basis of the price of the asset on the day in which they passed. This eliminates the deceased spouse’s portion of capital gains.

We’re Here to Help

Minimizing capital gains taxes is only one component of your financial well-being. After all, having to pay capital gains taxes is a positive sign that your investment strategies are doing well. Reaching your financial goals requires a holistic approach that takes many factors into consideration. Partnering with a financial professional can help you create a plan that is optimized to reach your financial goals. Schedule a complimentary introductory call by reaching out to me at 305.723.9949 or mike.collopy@veracitycapital.com.

About Michael

Mike Collopy is wealth advisor and partner at Veracity Capital. As a fiduciary who puts his clients’ interests first, always, Mike is known for providing a holistic perspective on his clients’ finances. His comprehensive process first looks at the big picture of each client’s family, health, and wealth, then drills down to provide solutions for their financial needs, concerns, and goals. He’s passionate about the science of financial planning and investing and uses that to help his clients build a strong foundation for their financial life. Mike serves career-driven individuals who need professional advice to manage their wealth and maximize their opportunities, such as corporate benefits and complicated compensation packages. He considers his clients to be like family, and strives to support them and their families as they work hard for their financial future.

Mike has a bachelor’s degree in finance from Coastal Carolina University and an MBA from The College of Saint Rose. He is also a CERTIFIED FINANCIAL PLANNER™ practitioner. When he’s not working, you can find Mike spending time with his wife and young son, often exploring the great outdoors by hiking or enjoying the beach. He likes to stay active, playing basketball and training for half marathons. Mike gives back to the community by supporting organizations dedicated to finding treatments for cystic fibrosis. To learn more about Mike, connect with him on LinkedIn.

________________

(1) https://www.nerdwallet.com/article/taxes/federal-income-tax-brackets

(2) https://www.irs.gov/taxtopics/tc409

(3) https://www.irs.gov/taxtopics/tc701